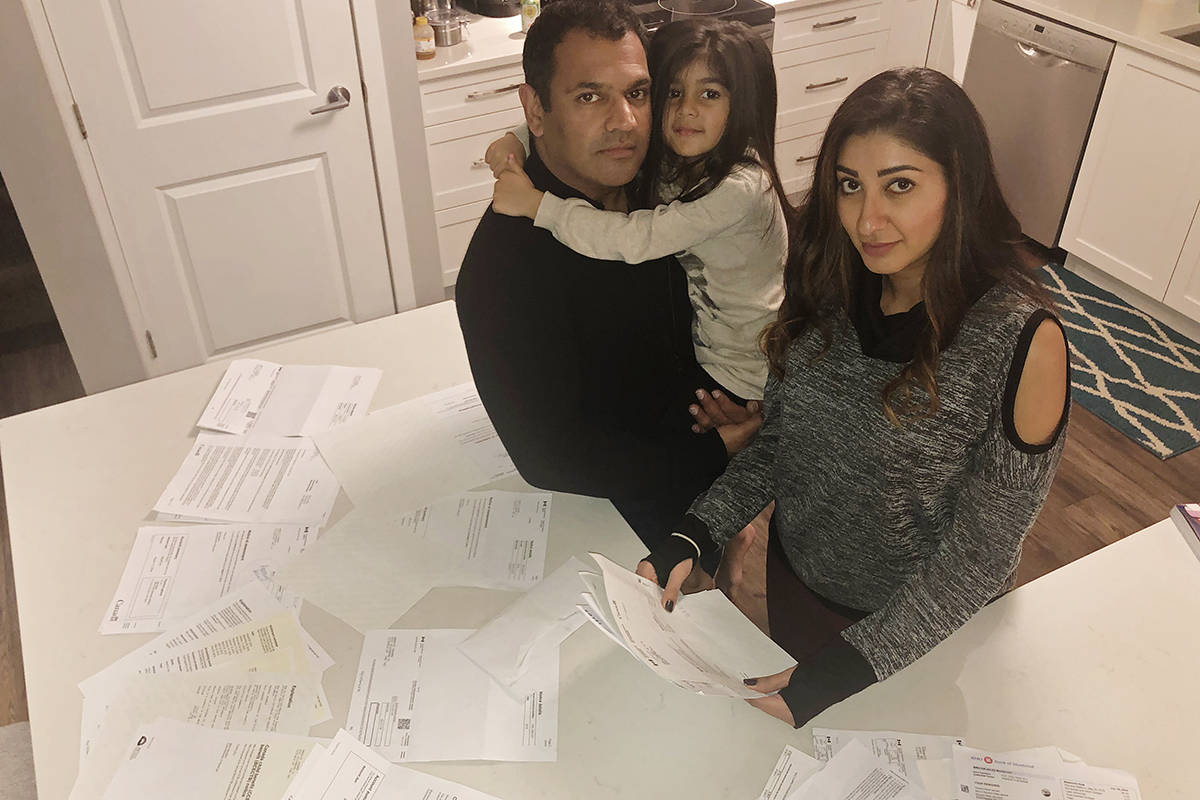

Rishi and Amy Sharma in Gordon Head were shocked earlier this year when they received an adjusted tax bill for the 2016 tax year from Canada Revenue Agency that said they owed $8,943 and change.

The main problem was that CRA dismissed the Sharmas’ childcare claims of more than $18,000, among other factors.

“Amy has two jobs, we try to ensure everything is by the book,” said Rishi, a government manager. “When we get a bill for $8000, I’m like, ‘Holy shoot, you kidding me?’”

What really set the Sharmas over the top was the eight-month, back-and-forth rigmarole to try and prove their tax claims, Rishi said.

First, the couple had to prove their children existed. “Children who have had SIN numbers since birth,” Amy said.

“The process was ridiculous,” she added. “You call the number at the bottom of the letter, they answer, ‘sorry, we don’t deal with this.’ You’re constantly bounced from one place to another.”

Eventually, CRA confirmed the Sharmas have children. But CRA still didn’t accept the childcare expenses, Rishi said.

“But you can’t call anyone to get a straight answer, or just some help,” Rishi added.

The childcare expenses came down to the use of in-house nannies that CRA needed better proof of.

READ ALSO: Canadians tuning out real CRA agents because of CRA phone scammers

It was understandable, but took a long time and could have been easily explained, Rishi said.

“We hire locally, they’re usually students who come and go, and they travel. So it was cumbersome. One was traveling in Australia and New Zealand, one was in Vancouver, we don’t keep in contact with the nannies after they’re gone.”

Each one submitted a signed letter that they’d received the claimed money for child care.

As of last week, the tax bill had been reduced from $8,300 to a little more than $3,000 with the Sharmas’ accountant telling them the rest of the bill should also be reduced, Rishi said.

At one point, Rishi was so frustrated with the process he called the office of the signatory whose name is on the letters they keep getting, Bob Hamilton, commissioner of the CRA.

Someone in his office answered but said, “‘Sorry, we don’t deal with that, why are you calling us, this is the wrong department.’” Rishi said. “I said, because ‘his name is on the letter.’ So something is completely screwed up here, it’s 2018. Why is this so difficult.”

All the while, however, interest was accumulating.

“It’s very scary, very stressful, and very frustrating,” Rishi said. “All this information is due in a little amount of time, the letter is very threatening, it says we face penalties and interest.

“We need to fix the system so we can have more of a conversation with someone. Someone we can say, ‘We’re sorry, just explain what we need to do, so we can do it.’ This has taken eight months and we do end up with an accounting bill.”